Within the current fast-paced financial environment, understanding equity evaluation is not just a privilege but a necessity for individuals seeking to execute well-informed choices. As stock markets continuously in flux, individuals and businesses alike are seeking the knowledge of equity evaluation experts to maneuver through the intricacies of investment opportunities. Such experts have the training and insights to assess companies, assess their capacity for growth, and provide solid advice tailored to different risk appetites.

Equity analysis goes beyond simple calculation; it involves a thorough examination into a company's core metrics, market trends, and sector changes. By leveraging the expertise of specialists, investors can spot mispriced stocks and capitalize on opportunities that may typically be overlooked. Regardless of whether you're a veteran investor or just starting out, utilizing the expertise of equity evaluation experts can be a game changer in your investment strategy, aiding you make choices that suit your financial goals.

Grasping Equity Analysis

Equity evaluation is a thorough approach to analyzing a company's stock to determine its capability for investment. It requires reviewing financial statements, market conditions, and economic indicators to evaluate a company's efficacy and future growth opportunities. By grasping equity research report of a firm, equity analysts aim to provide insights that can help investors in making educated decisions.

One key aspect of equity analysis is the assessment of a company's financial health. Analysts assess various metrics such as earnings per share, price-to-earnings ratio, and return on equity. These measures help investors grasp how well a company is producing profit in comparison to its revenue and how efficiently it is using its assets. Furthermore, patterns in these metrics over periods can signal the stability or instability of a company's financial position.

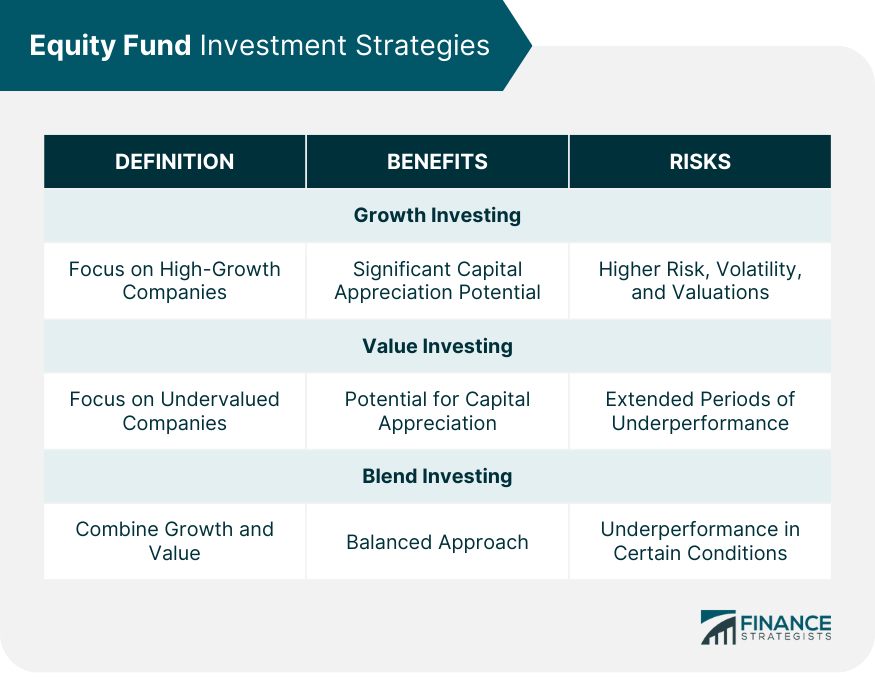

Beyond financial metrics, equity analysis also incorporates non-numeric factors such as the effectiveness of management, industry position, and competitive landscape. Analysts factor in how external factors, including regulatory changes and market shifts, may influence a company's operations. This comprehensive approach not only helps identify undervalued stocks but also provides a clearer picture of the risks and rewards linked to potential investments.

Key Metrics and Ratios

When performing equity analysis, grasping key metrics and ratios is vital for assessing a company's fiscal well-being and performance. One of the key ratios is the price-to-earnings (P/E) ratio, that compares a company's present share price to its earnings per share. A elevated P/E ratio may indicate that investors foresee future growth, while a lower P/E could suggest that the stock is undervalued or that the company is facing challenges.

Equity analysis specialists utilize this ratio to identify potential investment opportunities and assess whether a stock's price is supported by its earnings.

An additional crucial metric is the return on equity (ROE), that measures a company's profitability in relation to shareholders' equity. ROE indicates how efficiently management is using the equity put in by shareholders to generate profits. A stable or increasing ROE is a favorable sign, signaling that a company is generating returns for its investors. Equity analysts closely monitor ROE trends as they evaluate a company's performance over time and contrast it against competitors.

Furthermore, analysts often employ debt-to-equity (D/E) ratio to assess a company's financial leverage and risk profile. This ratio compares a company's total liabilities to its shareholder equity, demonstrating how much debt is employed to finance its operations. A elevated D/E ratio may raise concerns about financial stability, especially in periods of recession. By assessing these metrics and ratios, equity analysis specialists can provide informed insights and help investors make informed decisions in the market.

Effective Application Methods

To efficiently employ equity analysis specialists, commence by precisely defining your investment goals and risk tolerance. Identifying what you desire to achieve helps specialists tailor their insights to fulfill your particular needs. Whether you are seeking sustainable growth, income through dividends, or a combination of both, articulating your goals allows for more concentrated analysis and recommendations. It is important to create a team-oriented environment where you can share your thoughts while also being welcoming to expert advice.

Following this, set up a routine for reviewing equity analysis reports and insights provided by your specialists. Frequent engagement with their findings not only enhances your understanding of market trends but also enables you to make educated decisions swiftly. Designate specific times to examine these analyses and contemplate discussing them with your specialists to clarify any uncertainties. This kind of forward-thinking approach ensures you stay coherent with your investment strategy and market movements.

Finally, incorporate the insights gained from equity analysis into your broader investment strategy. Use the information acquired from specialists to make modifications to your portfolio as needed. When specialists point out potential opportunities or risks, evaluate how these fit with your overall strategy. This responsive relationship can lead to more intelligent decisions and ultimately improved investment outcomes, guaranteeing that you harness the full potential of detailed equity analysis.